Many of us feel Insurance is Liability and Hesitant to do it. Whereas, Insurance is Risk aversion tool and not investment tool. Can I club Investment and Insurance Risk cover together? Answer is yes. We will see how to do it.

Major Risk & Insurance covers:-

- Term Plan for Family protection

- Health Insurance for Prevention from Any un expected medical emergency

- Personal accident cover

- Motor Premium

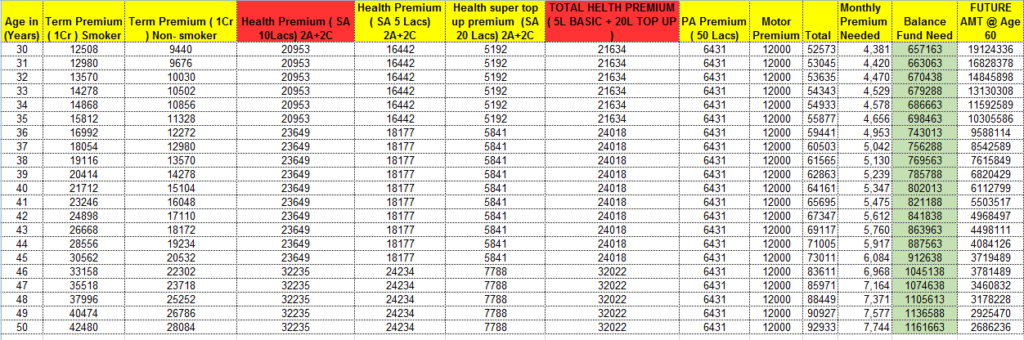

We will see generic table for all age group from 30-50 for expected Annual Insurance amount Expected.

Solution for Making our Insurance cost Tension free and also growing that money:-

- For person age 30, if the Total insurance cost per annum is 52573 Rs..

- He need to invest 657200 rs in good quality Hybrid Fund with Systematic withdrawal plan of 52573 rs. ( Roughly 8 % withdrawal per year)

- You can plan your SWP on the dates 15 days prior to your due dates.

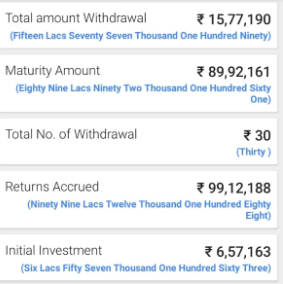

- Once you retire at 60, the Balance fund money even after covering your Insurance cost of approximately 15,77,190 Rs, It will generate 89,92,161 Rs.( Tentatively at 12% CAGR growth)